Y Combinator, which helped incubate Airbnb Inc. and Instacart Inc., has a reputation for having an application process thats more exclusive than Harvard Universitys. About 6,000 aspiring startups applied to the Silicon Valley business incubators summer 2016 class in hopes of being one of the 107 or so to receive a $120,000 investment and access to the groups well-connected investors and executives.

Beneath the techie buzzwords and fanciful projections, the applications provide a unique view into the rapidly changing technology scene from the perspective of up-and-comers. Online marketing and data firm Priceonomics recently analyzed eight years of Y Combinator submissions. The results give a snapshot of industry trends and entrepreneurs views of whos hot and whos not in tech.

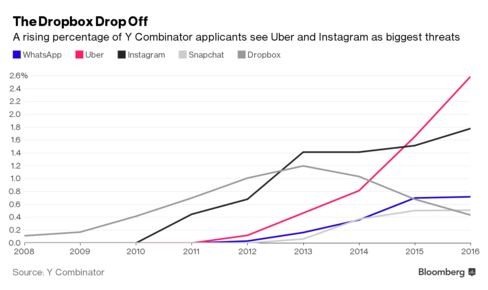

Y Combinator asks applicants to list their competitors. Google Inc. and Facebook Inc. dominate the responses, but Uber Technologies Inc. and Airbnb are gaining quickly. Their names were mentioned more than half as many times as Googles in 2016, according to the Priceonomics analysis. Uber, a ride-hailing company thats established itself as a Valley golden child with a valuation of $62.5 billion, was mentioned in 2.6 percent of applications this year.

Slack Technologies Inc., a messaging app for businesses, has seen a significant uptick in mentions. Bloomberg Beta, the venture capital arm of Bloomberg LP, is an investor in Slack. Willett Advisors, the investment arm for the personal and philanthropic assets of Michael R. Bloomberg, the founder of Bloomberg LP, invests in Y Combinator startups.

Facebooks Instagram is a perennial threat on startups radar. But WhatsApp, which Facebook spent far more to acquire in a $22 billion deal, has plateaued in the eyes of Y Combinator hopefuls. Snapchat Inc., another messaging app Facebook has targeted, was on a similar trajectory in the last year.

For Dropbox Inc., the hype cycle has been winding down for the last few years. After leading a list of five highly valued private companies in 2012, Dropboxs presence in Y Combinator submissions has been on a steady decline since 2013, according to the Priceonomics study. Dropboxs drop coincides with concerns expressed by the companys own investors, several of which have repeatedly written down the value of their stakes.

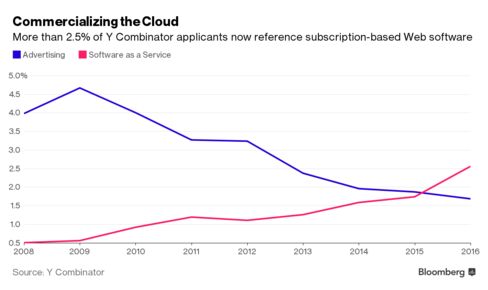

However, Dropbox, which makes money by charging users for more cloud storage space, is well-positioned for another trend: the rise of subscription-based software businesses. Y Combinator applicants have increased references to so-called software-as-a-service revenue models by 400 percent since 2008. Meanwhile, advertising is falling out of vogue.

The shift highlights a rush toward sustainable, more predictable businesses as venture capitalists begin to prioritize revenue over user growth. Startups are staying private longer — no tech company went public last quarter — leaving VCs concerned theyll have to invest more over longer periods of time to keep startups afloat.

Read more: www.bloomberg.com

![[Video] How to get rid of bed bugs in Toronto](https://www.thehowtozone.com/wp-content/uploads/2019/10/maxresdefault-2-100x70.jpg)